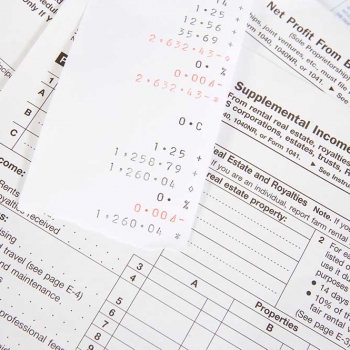

The budget bill just passed by the legislature, and signed into law by the Governor, may have the effect of impoverishing seniors. Here is why. Under current law, when either a husband or wife needs nursing home care, or care under the Connecticut Medicaid Home Care Program, the healthy spouse can keep $109,560 of assets. That in itself is not much to live on for the rest of your life, especially if you are in your 70’s when your spouse becomes sick.